There are many branchless options for Americans to bank and invest. In this case, that’s a positive thing overall. More options are preferable to fewer when your goal is to keep your money safe and help it grow over time. Wealthfront vs. Chime – Which Banking App Is Best?

But there’s a thin line between “more” and “too much.” Every month, the list of the best online banks gets broader as new fintech companies enter the market and older ones update their services.

To keep things simple, this side-by-side comparison only shows two branchless money management options: Chime® and Wealthfront. Both offer bank accounts with FDIC insurance, a wide range of mobile services, and customer-friendly extras like early direct deposit (where available).

Key Features of Wealthfront vs. Chime – Which Banking App Is Best?

But there’s plenty to distinguish Chime and Wealthfront as well — notably, the latter’s much broader lineup of features and services beyond its deposit account. Use this comparison to decide which of the two is a better fit for your own online banking and personal finance needs.

The biggest differences between Wealthfront and Chime revolve around the former’s investment management account, financial planning services, and portfolio line of credit.

Deposit Accounts at Wealthfront vs. Chime – Which Banking App Is Best?

Chime and Wealthfront both offer FDIC-insured deposit accounts. Wealthfront also offers an investment management account and a portfolio line of credit.

Chime’s Deposit Accounts

Chime has two aptly named deposit accounts: the Chime Checking Account and Savings Account.

The Chime Checking Account is a basic checking account with no minimum opening deposit or ongoing minimum balance requirements and no monthly maintenance fees. Indeed, this account has virtually no fees at all. It comes with a chip-enabled Chime Visa® Debit Card1 that’s accepted anywhere Visa is and offers fee-free access to approximately 47,000 free ATMs6 in the U.S. through the MoneyPass and Visa Plus Alliance networks.

Chime does charge $2.50 for each withdrawal made at an ATM or branch that is not in its network. Chime works with Apple Pay, Samsung Pay, and Google Pay, as well as a number of mobile peer-to-peer transfer apps.

Other benefits include a free way to pay bills online, no fees for overdrafts up to $200 for qualified members with SpotMe®2, the ability to cut cheques, and daily balance alerts in the app.

Chime’s account for saving, The Chime Savings Account, is a simple account with a variable interest rate that can change at any time. It includes two ways to save money automatically: Round Ups and Automatic Savings.

The first one automatically rounds up debit card purchases to the nearest dollar and puts the extra money into your savings account. Automatic Savings⁴ lets you automatically move some of your direct deposits of $1 or more from your Checking Account to the Chime account(s) you choose.

Chime doesn’t let couples who have combined their finances open joint accounts. You need to connect your various Chime deposit accounts using a third-party budgeting tool so that you and your partner, roommates, or other people can manage your family finances with just one sign-on.

There is one more thing to know about Chime’s deposit accounts: account users who get direct deposits of $200 or more a month can overdraft without paying a fee. SpotMe®2 is the name of this functionality. Users that are approved can receive an overdraft of up to $200 without paying a fee. They can keep that negative balance until their next direct deposit without paying a fee or having the transaction denied. SpotMe accepts optional “tips,” but they don’t affect how users feel about the service.

Wealthfront’s Deposit Accounts

Wealthfront offers an FDIC-insured cash management account (the Cash Account) with a variable yield and checking-like features that make it suitable for everyday use.

For a limited time, get $30 bonus cash when you open a Wealthfront Cash Account and fund your new account with at least $500 in new money. Terms apply. Open your account here7.

This account has FDIC insurance on balances up to $8 million ($16 million for joint accounts), well above the standard $250,000 limit.

It has some other notable benefits, including:

- A token minimum deposit requirement of $1

- A debit card accepted by millions of merchants

- Mobile cheque deposit

- The account offers a variable yield, currently at 5.00% APY, which is comparable to high-yield savings accounts.

- Pay cheque direct deposit up to two days early for account holders with qualifying employers

- Free bill pay and mobile transfers

- No overdraft fees

- Autopilot, a feature that executes automatic rolling transfers to your individual investing account when you specify a maximum Cash Account balance

- Self-Driving Money ™, a money management automation feature that effortlessly allocates incoming funds to budgeted expenses (including those paid by cheque as needed), emergency fund balances, savings goals, and long-term investments, all within minutes of deposit.

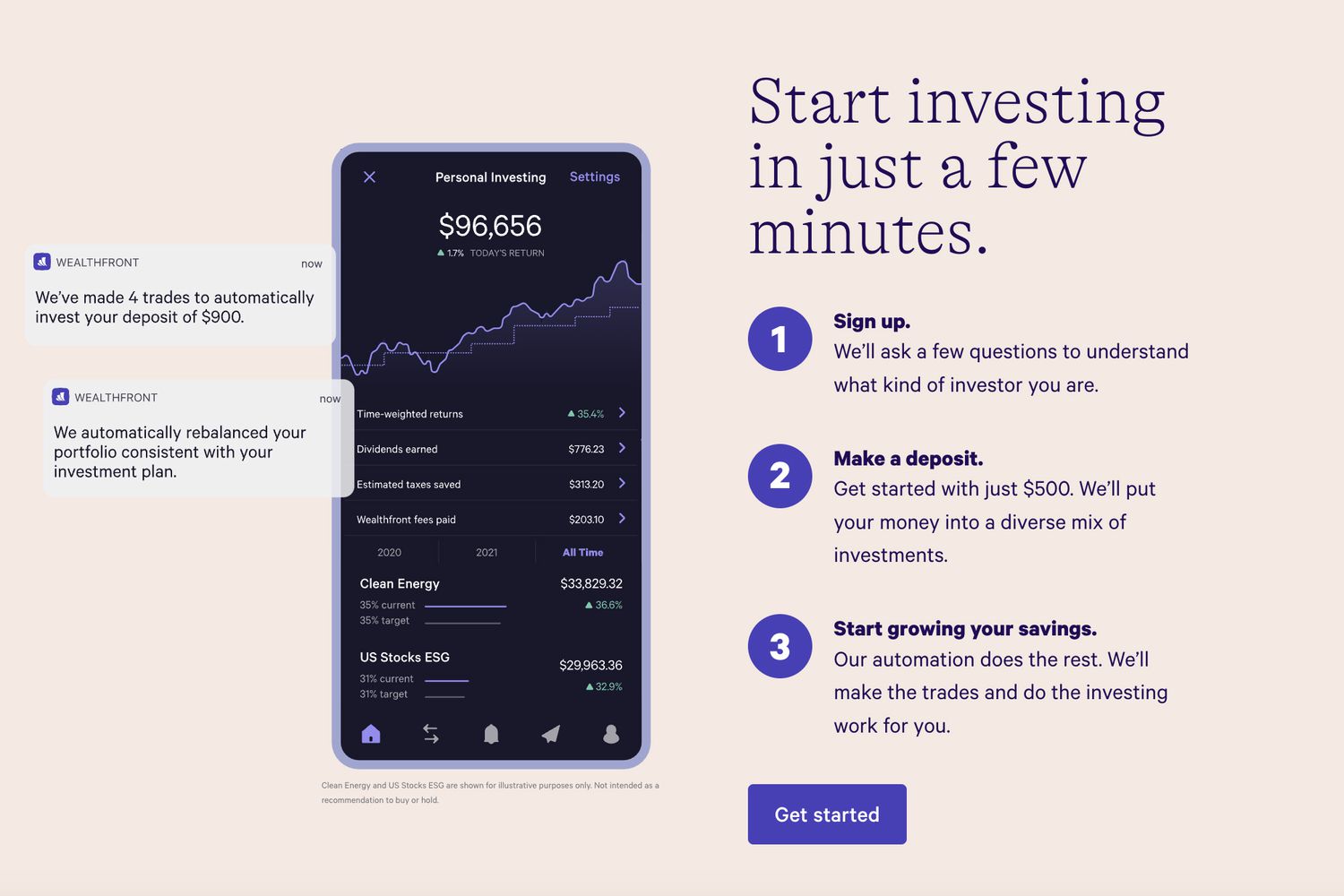

Wealthfront’s Investment Accounts

Wealthfront has taxable and tax-advantaged investment accounts. For example, they provide a taxable broking account for general investing, a tax-advantaged (IRA) for retirement accounts, and a 529 plan for school savings.

The minimum amount for these investment accounts is only $500. They offer free rebalancing on a regular basis along with dynamic tax-loss harvesting.

Wealthfront customises these accounts with low-cost exchange-traded funds (ETFs) that fit the holder’s risk tolerance and long-term investment goals. The advisory fee is always 0.25% of the assets under management, no matter what sort of account or how much money is in it. Most of the time, the annual costs of component funds are 0.15% or less.

Chime’s Investment Accounts on Wealthfront vs. Chime – Which Banking App Is Best?

Chime doesn’t offer any investing accounts at present.

Wealthfront’s Portfolio Line of Credit

Wealthfront’s Portfolio Line of Credit is a margin lending product that allows account holders with at least $25,000 in invested assets to borrow up to 30% of their portfolio’s value at low interest rates (currently no more than 3.65%, but subject to change) with no fixed repayment schedule.

Portfolio assets serve as collateral for any draws and are sold if the account lapses into delinquency. Wealthfront’s portfolio lines of credit can be used for virtually any legitimate purpose.

Chime’s Portfolio Line of Credit

Chime doesn’t offer a portfolio line of credit at present.

Financial Planning and Advice on Wealthfront vs. Chime – Which Banking App Is Best?

One of the biggest distinctions between Wealthfront and Chime is the former’s financial planning solutions. Although Wealthfront doesn’t employ client-facing human financial advisors or broker direct relationships between clients and third-party advisors, it does offer automated financial planning modules and a slew of high-level financial content for DIY planners.

Wealthfront’s Financial Planning and Advice Services

Wealthfront offers in-depth guides for users weighing major life decisions, plus one-off financial planning modules for several common life situations.

Wealthfront’s financial planning modules cover four common life situations or goals:

- Saving for retirement

- Buying a home

- Paying for a college education

- Taking time off to travel

For each, the user answers specific questions related to their assets, plans, goals, and overall financial picture. Wealthfront uses these inputs to generate a detailed plan that lays out the steps needed to achieve the goal as defined.

For people not sure where to begin their financial planning journeys, Wealthfront also offers more general financial planning support.

Separately, Wealthfront provides static but in-depth guides for users who’d simply like to learn more about common financial planning issues. These guides cover topics like homebuying and employee equity, including guidance around preparing for a closely held company’s initial public offering (IPO) and exercising employee stock options.

Wealthfront maintains a separate app—really, a sophisticated net worth calculator that helps users calculate and project net worth in a variety of scenarios.

Chime’s Financial Planning and Advice Services

Chime doesn’t offer any financial planning or advice services at present.

The Verdict: Are Chime or Wealthfront Right for You?

Enough distinguishes Wealthfront and Chime to make this something more than an idle question. Before determining which you should use for your money management needs, carefully consider their respective strong suits and drawbacks.

You Should Open a Chime Account If…

Chime is ideal for your needs if:

- You Don’t Need Extra Bells and Whistles. Chime does not have a lot of extra weight on it. That’s not necessarily a bad thing—it’s a lightweight financial product for users who don’t need much more than basic spending, saving, and money management tools, plus access to plenty of network ATMs.

- You Want to Be Able to Cut Cheques to Payees. Although it’s decidedly mobile-first and has a great mobile app, Chime does have one old-fashioned feature that could be useful for some account holders: a free bill pay system that offers a paper cheque option. If your landlord prefers paper rent cheques, this feature will certainly come in handy.

You Should Open a Wealthfront Account if…

Wealthfront is a better fit if:

- You’re Seeking a Low-Cost Robo-Advisor. Wealthfront’s low-cost investment management solution is one of the best robo-advisor services on the market today. Chime falls short for retail investors due to its lack of a comparable offering.

- You’d Like to Borrow Against the Value of Your Investment Portfolio. Wealthfront’s portfolio line of credit is an excellent alternative to a home equity loan or line of credit and is vastly superior to high-interest credit cards or unsecured personal loans. Chime doesn’t offer anything similar.

- You Want Financial Planning Help. Although Wealthfront doesn’t have advisors on staff or relationships with third-party advisors, it does offer basic financial planning help, a useful financial calculator app, and in-depth guides for DIYers. Chime, on the other hand, provides no such assistance.

Both Are Great If…

You can’t go wrong with either Wealthfront or Chime if you dislike banking in person.

- You Dislike Banking In-Branch. Neither Wealthfront nor Chime has physical branches or public offices. That’s how their users like it, albeit with wide-ranging debit card acceptance at millions of merchants worldwide. In either scenario, the nearest branch you’ll need to visit is your preferred ATM vestibule, provided it’s within the network.

- You Need an Extra Nudge to Save. Chime offers two ways to automatically save: a round-up-the-change feature and an automatic pay cheque savings feature4. Wealthfront automates cash-to-investing transfers with Autopilot, a smart feature that lets you specify a maximum Cash Account balance and automatically invest the rest. Use any (or all) to maximize what you put away.

- You Love Getting Paid Early. Both Wealthfront and Chime offer early direct deposit up to two days in advance3 for account holders whose employers qualify. This is excellent news for those with tight cash flows — folks for whom every day counts in the race to make it to payday and avoid predatory lending products such as high-interest cash advances or payday loans.

- You’re Tired of Bank Fees. Neither Wealthfront nor Chime charges excessive fees. Indeed, on the deposit account side, neither levies monthly maintenance fees, making for a totally fee-free money management experience under normal circumstances.

Final Word on Wealthfront vs. Chime – Which Banking App Is Best?

The prospect of choosing a new financial solution for your banking, investing, borrowing, and budgeting needs should not inspire dread.

Sure, there’s no shortage of choice out there, and some options seem all but interchangeable. But, if you look closely, you’ll find enough points of distinction between even the most similar-seeming services.

That’s certainly the case for Wealthfront and Chime, whose differences far outweigh their similarities. After reading through this detailed comparison of their strengths and weaknesses, here’s hoping you’re inching closer to a decision.